Beijing’s Strategic Calculus: More Than a Temporary Halt: China’s H200 blockade is reshaping global tech power and supply chains: Customs decision on Nvidia chips could define global AI leadership for decade

Beijing’s decision is neither simply procedural nor clearly articulated by official decree. Chinese authorities have not publicly codified a formal ban, and no authoritative explanation has been released. Yet the tone of internal directives, describing the chips as “not permitted” and advising firms to pause orders, has been interpreted by industry insiders as de facto prohibition or highly restrictive conditional access.

Several interpretations have emerged among analysts in Beijing, Washington, and Taipei:

1. Protecting and Promoting Domestic Semiconductor Development

China’s leadership has long pursued self-sufficiency in semiconductors, aiming to reduce reliance on Western technology as part of its broader national strategy. Advanced AI chips such as Nvidia’s represent both a technological dependency and a strategic vulnerability. Limiting their import can incentivize investment in domestic alternatives and aid indigenous champions like Huawei, Baidu’s Kunlun line, or emerging firms designing AI accelerators.

2. Geopolitical Bargaining Tool

China’s blockade might be intended as leverage in diplomatic negotiations with the United States. With President Trump’s administration having signaled a willingness to allow controlled H200 exports, under conditions that include testing requirements and limits on use, Beijing may be signaling it will not play along without concessions in broader trade or technology discussions.

3. Strategic Security Considerations

High-performance computing is not solely commercial. Governments around the world harness such hardware for defense, surveillance, and research that touches on national security. For China, controlling access to the most advanced non-military compute may be a precaution against foreign influence or oversight, even if exported under U.S. conditions limiting military use.

Whatever the rationale, the absence of clarity and the sudden suspension of imports have spurred both confusion and recalibration among Chinese technology firms and global semiconductor suppliers.

US Context: Export Controls, Tariffs, and Strategic Trade Policy

The H200 controversy is deeply intertwined with US policies on semiconductor export controls, which for years have sought to limit China’s access to the most advanced AI accelerators. Under previous regulations, Nvidia’s H100 and other high-end chips were barred from China entirely due to national security concerns. However, in December 2025 the US government approved the sale of H200 chips to China under strict conditions, including third-party testing for AI capabilities, assurances against military use, and volume caps tied to US domestic supply. A 25% tariff was also applied to exported chips routed through US territory.

This shift reflected Washington’s desire to balance competitiveness and control: maintaining U.S. technological dominance while still allowing regulated commercial engagement. Indeed, before the block, Nvidia planned to fulfill initial orders by mid-February 2026, possibly shipping tens of thousands of units from existing inventory.

Yet Beijing’s customs action demonstrates the fragility of such arrangements when domestic and international priorities diverge. The tug-of-war over who benefits from advanced AI infrastructure has now moved past export clearances to active gatekeeping at the point of import.

Economic and Supply-Chain Consequences

For Nvidia and Global Markets

China has historically been a major revenue source for semiconductor giants, accounting for a meaningful slice of Nvidia’s revenue mix before export restrictions were tightened. Although the Chinese share dipped sharply in late 2025 due to previous bans on H100 and other advanced processors, reopening access to H200 was seen as a partial recovery.

With imports blocked, suppliers that had scaled up for high volume face idle production lines and inventory challenges, leading some to halt production entirely. This disruption not only affects Nvidia’s near-term revenue forecasts but also highlights the fragility of semiconductor supply chains that are deeply cross-border and reliant on regulatory clarity.

For Chinese AI Development

Chinese AI projects, ranging from cloud infrastructure to large language model training, are architected around the compute capabilities that chips like the H200 deliver. If access remains limited or highly conditional, domestic companies may pivot more aggressively to local hardware alternatives or seek workarounds, including accelerated development of proprietary silicon, white-label designs, or even acquiring older but capable chips from secondary markets.

However, indigenous chips currently lag behind leading Nvidia products in performance and ecosystem support, meaning teams backed by sophisticated compute may temporarily face productivity or innovation slowdowns unless the policy landscape shifts.

Strategic Tech Cold War: China vs US in Semiconductor Era

The H200 blockade should not be viewed in isolation. It is a chapter in a broader strategic rivalry over who defines the global technology stack of the future:

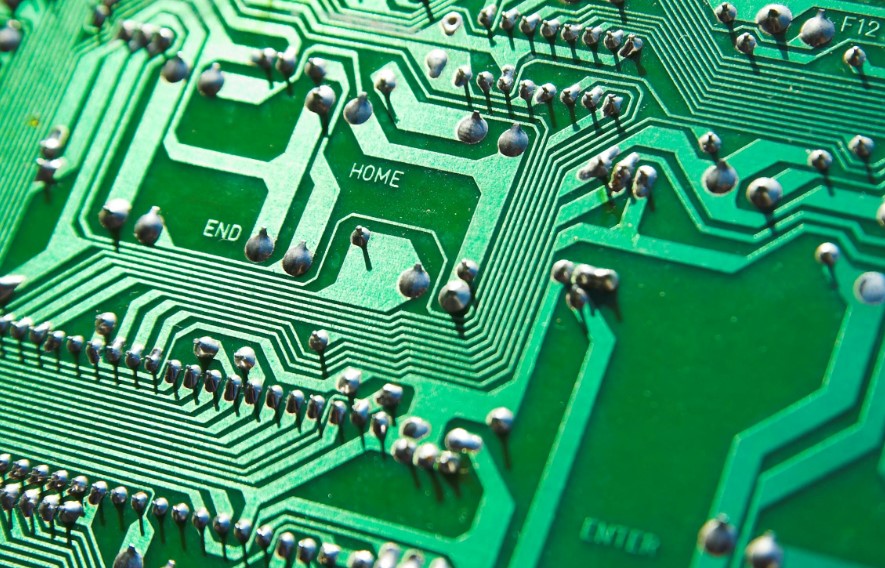

- AI chips are the foundation of modern artificial intelligence, underpinning cloud services, autonomous systems, and next-gen digital infrastructure.

- Semiconductor sovereignty has become central to national resilience, pushing governments to reduce dependence on foreign hardware.

- Trade policy and export controls are now intertwined with economic diplomacy and national security.

Analysts have likened this period to a technology “cold war”, where supply chains, standards, and chip access become as strategic as military capability. The tug between US desire to maintain leadership and China’s ambition for self-reliant innovation is driving policy maneuvers that ripple across markets and innovation ecosystems.

Industry Reaction and Corporate Strategy

Nvidia’s leadership, including CEO Jensen Huang, had actively lobbied both Washington and Beijing to obtain export and import approvals, anticipating robust Chinese demand. Prior to the blockade, Nvidia predicted over one million orders from Chinese customers, a figure that underscores how lucrative and significant the market remains.

Now, with imports stalled, global chip companies must adjust production plans and customer strategies. Some clients have reportedly canceled orders or sought alternative chips on the grey market, including more advanced models like the Blackwell series, despite those being officially restricted.

For Chinese firms, the imperative to adopt domestic silicon has accelerated. Government directives urging companies to halt purchases and reconsider reliance on foreign chips reinforce Beijing’s broader policy messages about technological self-sufficiency.

What Comes Next: Possible Futures in Chip Diplomacy

The situation remains dynamic, with several possible paths emerging:

1. Formalized Regulatory Framework

China might formalize restrictions with licensing conditions, similar to U.S. export controls, permitting limited imports under vetted circumstances. Industry sources suggest Beijing is drafting rules to regulate acquisitions rather than banning them outright.

2. Strategic Compromise in US-China Talks

The chip issue could become part of broader negotiations between Washington and Beijing, especially as political leaders engage in diplomatic dialogue. Trade-offs might involve staged relaxations of restrictions in exchange for commitments on intellectual property, joint standards, or dual-use technologies.

3. Accelerated Domestic Chip Innovation

Denial of access to advanced foreign chips could hasten China’s investment in indigenous semiconductor design and fabrication, driving long-term transformation of its technology sector.

Each scenario carries distinct implications for global economics, technological innovation, and geopolitical alignment.

Conclusion: Nvidia Blockade as Turning Point

China’s move to block Nvidia’s H200 AI chip imports crystallizes a new era in semiconductor geopolitics, one where leading hardware is not just a commercial product but a strategic asset, a bargaining chip, and a point of national pride.

What’s happening at the customs gate in Shenzhen is emblematic of much larger trends: the fracturing of the global tech supply chain, the intertwining of economic and security policy, and the emergence of AI capability as a measure of national power.

In 2026 and beyond, decisions about who gets access to the world’s most advanced chips could matter as much as decisions about who leads in software or standards. For companies like Nvidia and countries like China and the United States, the stakes have never been higher.