Future of artificial intelligence is being built with machines, not code and the real AI arms race is not about models, it’s about who can build the chips.

Artificial intelligence is often framed as a software revolution. In reality, its most consequential impact may be unfolding far from chatbots and algorithms, inside the factories that build the machines powering the AI age.

According to industry forecasts from SEMI, global sales of chipmaking equipment are projected to rise 9% in 2026, reaching $126 billion, before climbing further to $135 billion in 2027. Behind these numbers lies a deeper story: AI is forcing the semiconductor industry into its largest capital expansion since the smartphone era.

The Invisible Backbone of the AI Economy

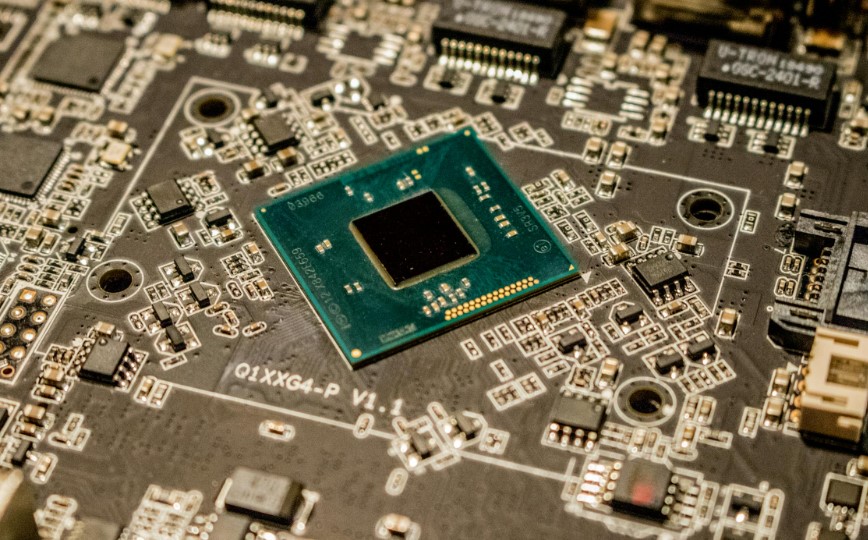

Every AI breakthrough, whether a large language model, autonomous vehicle system, or advanced data center, rests on a physical foundation: logic and memory chips manufactured with extreme precision.

Unlike previous tech waves driven by consumer demand, AI’s growth is compute-intensive, energy-hungry, and structurally dependent on advanced fabrication. This has shifted the center of gravity from software innovation to semiconductor manufacturing capacity.

The result is a renewed surge in spending on lithography systems, deposition tools, etching equipment, and metrology technologies, machines that cost tens to hundreds of millions of dollars each.

Why AI Changes the Chip Equation

AI workloads differ fundamentally from traditional computing:

- They require advanced logic nodes for performance efficiency

- They consume massive volumes of high-bandwidth memory

- They scale horizontally across thousands of accelerators

This combination forces manufacturers to invest aggressively in next-generation fabrication tools, often before demand fully materializes.

Unlike consumer electronics cycles, AI infrastructure spending is front-loaded, driven by strategic competition rather than short-term returns.

Asia Remains the Epicenter

SEMI projects that China, Taiwan, and South Korea will remain the world’s largest markets for chipmaking equipment. This reflects both industrial capacity and geopolitical urgency.

- Taiwan continues to anchor advanced logic manufacturing

- South Korea dominates memory production critical to AI workloads

- China, despite export controls, is accelerating domestic semiconductor investment

The concentration of equipment spending in East Asia underscores a stark reality: AI supply chains are geographically fragile and politically sensitive.

Capital Intensity Enters a New Era

The projected rise from $126 billion in 2026 to $135 billion in 2027 signals more than cyclical recovery, it marks a structural escalation in capital requirements.

Advanced fabs now demand:

- Multi-billion-dollar upfront investments

- Longer break-even timelines

- Closer coordination between chip designers, foundries, and equipment suppliers

This favors large incumbents and state-backed players, while raising barriers for new entrants.

Winners Beyond the Chipmakers

While semiconductor giants often dominate headlines, equipment manufacturers quietly capture some of the most stable value in the AI boom.

Unlike chip prices, which fluctuate, equipment demand rises with every new node transition and capacity expansion. This makes the sector less exposed to consumer cycles and more aligned with long-term technological trends.

As AI becomes embedded across industries, toolmakers become the true arms dealers of the digital age.

Geopolitics Shapes the Balance Sheet

The surge in equipment spending cannot be separated from geopolitics. Export controls, technology restrictions, and industrial policy are reshaping purchasing decisions.

Governments increasingly view semiconductor manufacturing as strategic infrastructure—on par with energy and defense. Subsidies, incentives, and localization mandates are now embedded in capital planning.

AI has transformed chipmaking from a commercial activity into a matter of national competitiveness.

Why This Boom Is Different From Past Cycles

Previous semiconductor booms were driven by:

- PCs

- Smartphones

- Consumer electronics

The AI cycle is driven by infrastructure investment, not discretionary spending. Cloud providers, governments, and enterprises are building capacity years in advance.

This reduces volatility but increases systemic risk. Overcapacity is possible, but undercapacity is politically unacceptable.

The Long Tail: Energy, Sustainability, and Supply Chains

As equipment spending rises, so do secondary challenges:

- Energy consumption of fabs strains national grids

- Water usage becomes a sustainability flashpoint

- Supply chain bottlenecks threaten production timelines

These pressures force innovation not just in chip design but in manufacturing efficiency itself.

AI’s future will be shaped as much by environmental constraints as by algorithmic progress.

What This Means for the AI Economy

The projected growth in chipmaking equipment sales is not a footnote, it is a leading indicator of how deeply AI is embedding itself into the global economy.

As hardware investment accelerates, AI transitions from experimentation to permanence. Once factories are built and tools installed, the ecosystem becomes self-reinforcing.

This is how technological eras lock themselves into history.

The Real AI Arms Race Is Industrial

The AI race is often framed as a competition between models and platforms. In reality, the decisive battles are being fought on factory floors and balance sheets.

Whoever controls the capacity to manufacture advanced chips will shape the pace, price, and power dynamics of artificial intelligence.

The surge in chipmaking equipment sales tells us one thing clearly: the AI era is no longer theoretical, it is being physically constructed.