As Global AI Spending Approaches $2.5 Trillion, Infrastructure Scarcity Reshapes Power

The world is not running out of ideas for artificial intelligence. It is running out of compute.

Global AI spending is forecast to reach $2.5 trillion in 2026, marking a 44% increase over 2025. But beneath that staggering headline lies a more consequential shift: a tightening grip on the hardware and data infrastructure that powers the AI economy.

Tech giants are racing to secure proprietary datasets, long-term GPU supply contracts, and vast data center expansions. The result is an emerging “AI oligopoly”, a small group of companies controlling the majority of advanced compute capacity.

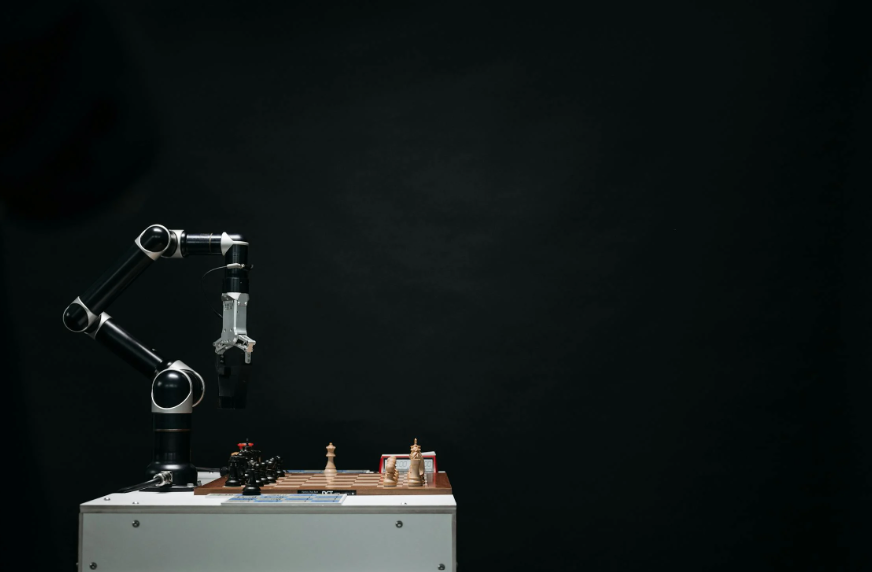

This is no longer a software revolution.

It is an infrastructure arms race.

Compute Bottleneck

Artificial intelligence models, particularly large-scale generative and agentic systems, require immense computational resources to train and deploy.

Key constraints include:

- High-performance GPUs

- Advanced networking interconnects

- AI-optimized memory systems

- Data center capacity

- Reliable, high-density energy supply

The companies most capable of absorbing these costs are hyperscalers such as Alphabet, Microsoft, Amazon, and Meta.

Their capital expenditures now dwarf those of entire national technology sectors.

GPUs: Scarce Currency of AI

At the center of the bottleneck is hardware.

Advanced AI accelerators produced by Nvidia and networking silicon from Broadcom have become the scarce commodities of the digital age.

Supply remains constrained due to:

- Manufacturing capacity limits

- Advanced semiconductor fabrication dependencies

- Export controls in certain markets

- Surging enterprise demand

Enterprises that once rented compute on-demand now find themselves competing for reserved GPU clusters months or years in advance.

The result is stratification: those with scale build; those without wait.

Proprietary Data as Competitive Moat

Hardware scarcity is only part of the equation.

Large AI models derive advantage not just from compute, but from exclusive datasets:

- Proprietary search and advertising data

- Enterprise productivity telemetry

- Social media engagement streams

- Retail and logistics data

These datasets are rarely accessible to smaller players.

The consolidation of compute plus data strengthens the market position of dominant firms, reinforcing what critics describe as an AI oligopoly.

$2.5 Trillion Signal

A 44% increase in global AI spending is not simply growth, it is acceleration.

The spending surge encompasses:

- AI software development

- Data center construction

- Semiconductor procurement

- Energy infrastructure

- Workforce retraining

Governments are also contributing through national AI initiatives and strategic subsidies.

In aggregate, the $2.5 trillion projection signals that AI is transitioning from innovation cycle to industrial transformation.

Energy and Physical Limits

Even if capital is abundant, physics imposes constraints.

Data centers require enormous energy density. Cooling systems strain water and power grids. Urban zoning and environmental permits slow expansion.

As hyperscalers expand capacity, they are:

- Securing renewable energy contracts

- Exploring nuclear partnerships

- Investing in energy-efficient chip architectures

Yet infrastructure expansion cannot occur overnight.

Scarcity persists — and scarcity concentrates power.

Oligopoly Question

Economic oligopolies emerge when high barriers to entry prevent competition.

In AI infrastructure, barriers include:

- Capital intensity (tens of billions per data center campus)

- Access to advanced semiconductor fabrication

- Long-term energy procurement agreements

- Engineering talent concentration

Critics argue that the consolidation of compute risks:

- Reduced innovation diversity

- Higher cloud pricing

- Limited startup competitiveness

- Increased geopolitical leverage

Defenders counter that scale is necessary for safety, efficiency, and global deployment.

The debate is not purely economic, it is strategic.

Global Implications

Nations lacking domestic hyperscalers face dependence on foreign cloud providers.

This raises concerns about:

- Data sovereignty

- National security

- Regulatory alignment

- Economic resilience

In response, some governments are funding sovereign AI infrastructure projects, though matching hyperscaler scale remains challenging.

The emerging dynamic resembles earlier energy geopolitics, except the scarce resource is compute.

Scarcity Be Solved?

There are three potential pressure valves:

1. Custom Silicon Diversification

Companies are designing in-house AI chips to reduce reliance on a single supplier ecosystem.

2. Algorithmic Efficiency

Research into smaller, more efficient models aims to reduce computational load.

3. Distributed Infrastructure

Federated systems and edge computing may partially decentralize AI workloads.

But none of these solutions eliminates the scale advantage of established players.

Paradox of Abundance and Concentration

AI promises abundance, automated productivity, accelerated research, economic expansion.

Yet its foundation is concentrated infrastructure.

The paradox is stark:

- Intelligence expands.

- Access narrows.

The firms controlling compute effectively gatekeep the pace of AI deployment across industries.

Who Owns the AI Century?

The forecast of $2.5 trillion in AI spending underscores the scale of transformation underway.

But money alone does not determine influence.

Control over compute, energy, and data defines the real power structure of the AI era.

If current trends continue, the AI economy may resemble a tightly clustered network of dominant infrastructure providers.

The central question for policymakers and markets alike is not whether AI will grow.

It is whether growth will remain open, or consolidate further.

In the age of artificial intelligence, the scarce resource is no longer information.

It is computation itself.